With the Moniflo app, Georges Bock is hoping to make investing not just more centred on values—but a more positive experience overall.

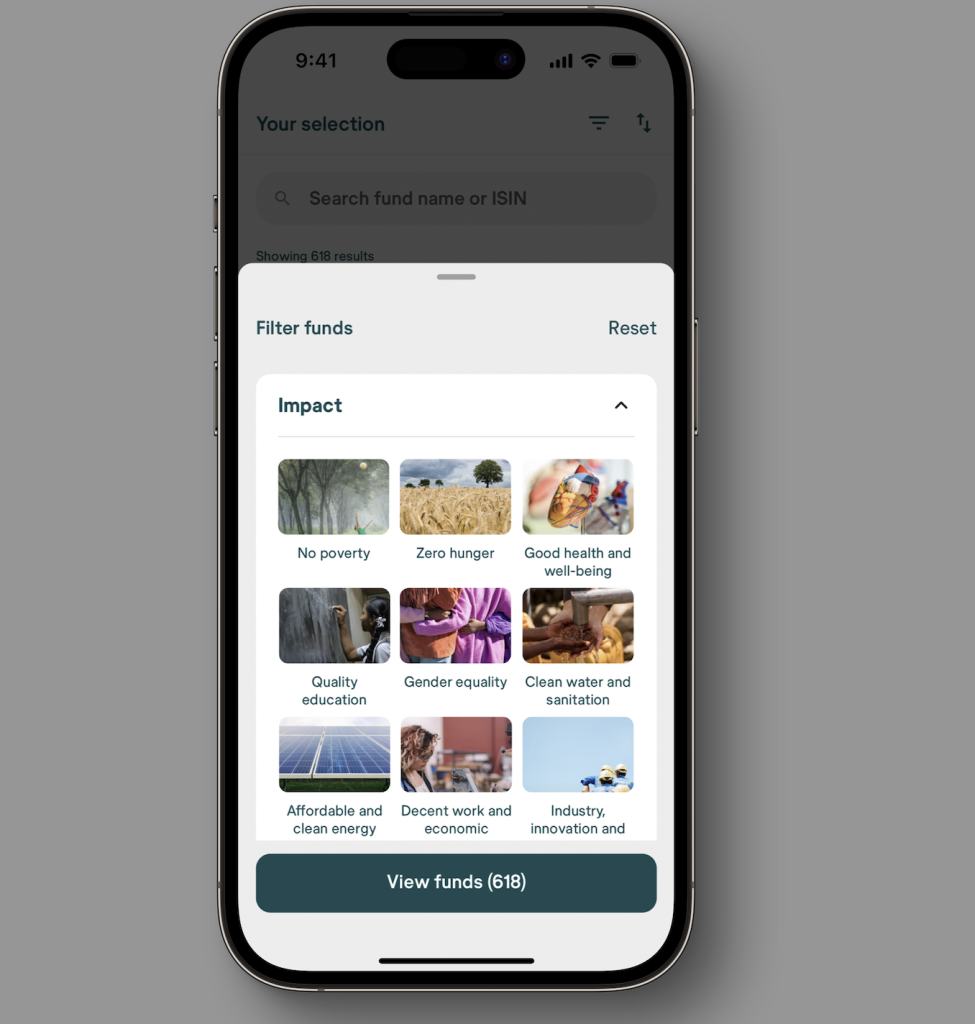

Moniflo, a mobile app built by Investre, aims to be more than an investment platform but a tool of empowerment, for beginners and pros alike. It allows users to search for funds aligning with their own impact-related goals—be they social, governance or environmental—and the visuals and user-friendliness contribute to the overall experience.

For CEO and founder Georges Bock, the emotionalisation of investing is important. “It can give you satisfaction if you know your money does not harm, or your money is supporting a certain kind of idea,” he explains. Transparency was one of the key goals when the app launched in 2024; users can exclude specific criteria they’d prefer not to invest in, for instance, and set their own risk appetite for funds.

“Financial education should not be about economics.”

In addition to being user-friendly and quick, the app tracks individual impact and includes related news and stories. “We use blockchain because it’s easier access, cheaper, reliable. It’s what the industry needs,” Bock explains. “Everybody has an advantage—we couldn’t have made such a financial offer on the basis of traditional technology.”

Now with the Blockchain Law IV having been passed in December 2024, building on its three previous iterations, Bock sees new potential. “The Blockchain IV law exactly [revolved around] what we do today, which is issuing securities tokens, reconciling those tokens with traditional records and safekeeping those tokens for those clients… what the new law has allowed is to use the technical capabilities that have already been built to be directly on the issuing side,” he explains.

Improving financial literacy

Empowering investors goes beyond just the blockchain-driven app, however. Moniflo also has a free-of-charge “investment school”, which has been held both in-person and online, aimed at a wide range of experience levels. New investors taking part in the course benefit from deciphering financial terms and learning the basics, like the difference between investing and speculating, while more advanced investors can gain in-depth strategies and analyses for different investment opportunities, plus tax-optimisation aspects.

Bock says the youngest person to attend the programme was around 16 years old, and sometimes it’s the youngsters who are encouraging their parents to join them. Bock’s a believer that more can be done when it comes to financial literacy, citing Denmark as a good case study. Denmark has made financial education—covering banking and budgeting, among other aspects—mandatory for students aged 13-15. According to the World Economic Forum, this programme “has contributed to Denmark’s impressive 71% financial literacy rate, one of the highest globally.”

Bock adds, “Financial education should not be about economics. One day you’re going to be an adult and earn money… maybe investing is a possibility for you, to make use of your money and approach this around financial well-being.”