Capital Group’s experts analyze the latest opportunities, and the undeniable appeal, of bond investing.

In the current context – falling interest rates, controlled inflation – bonds should continue to play their role of diversification compared to equities, while offering relatively attractive returns.

The power of yield

The hiking of interest rates by central banks in 2022-23, while painful at the time, had a silver lining: investors are now well compensated – in the form of historically high bond yields – for holding bonds as a defensive asset in volatile markets.

And even as central banks begin cutting interest rates, yields remain well above historical averages and comparable to levels at the start of the 2024. Inflation has also come down over this period, and consequently real yields (the nominal yield level minus the inflation rate) are now well into positive territory.

As well as a high starting yield, fixed income results could also benefit from the capital gains (due to a change in a bond’s price) that typically come with interest rate cuts. A marked shift in focus among central banks from concerns about inflation to a potential slowdown in economic growth means that many have already begun to cut interest rates. Lower interest rates can cause the price of bonds to rise, and this impact could lead to a positive contribution to portfolio results.

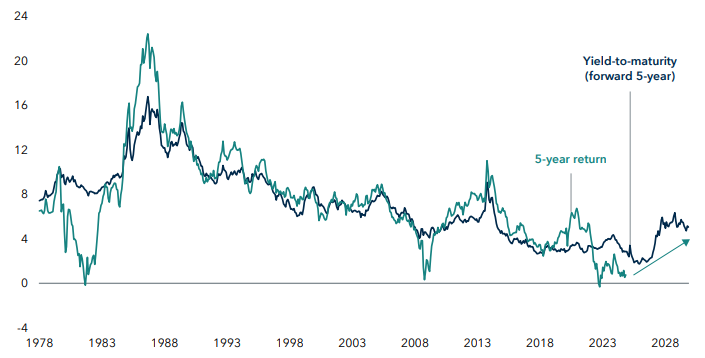

Starting yields have historically been a strong indicator of future results

5-year forward yield-to-maturity and 5-year annualised returns (%)

Historically, a bond’s 5-year return has broadly tracked the yield-to-maturity (YTM), making the current YTM a helpful indicator of the future returns an investor mught receive.

As inflation falls, bonds could again offer diversification benefits

One of the primary roles of bonds is to provide diversification from equities.

We reviewed over 50 years of past data to analyse the correlation between stock and bond returns at different levels of inflation. A negative correlation between stocks and bonds means their returns tend to move in opposite directions and hence provides diversification benefits (i.e., if equities fall, bonds tend to rise, and vice versa). A positive correlation implies both asset classes move in the same direction, and therefore any diversification benefits are lost.

Our analysis showed that the negative correlation between bonds and equities typically coincides with periods when inflation is close to the US Federal Reserve’s target rate of 2%. It has normally only been during periods of high inflation, such as in 2022, when these asset classes became positively correlated and the diversification benefits are lost.

Although inflation has ticked up in recent months, it remains relatively close to the US Federal Reserve’s 2% target. Using history as a guide, this would suggest we might be entering an environment in which bonds could continue to fulfil their traditional role as a portfolio diversifier.

A bias towards higher quality bonds

In the current environment, our fixed income analysts believe that income (from higher bond yields) is likely to be the dominant component of fixed income results, rather than changes in the underlying bond price.

Our portfolios currently have a bias towards higher-quality investment grade bonds. The reason is because credit spreads are very tight on a historical basis. Credit spreads represent additional compensation – in the form of a higher yield – an investor receives for investing in a bond that carries a higher risk than a safer asset, like US Treasury bonds. When spreads are tight (or low) – as they are now – it means the extra yield paid to investors is low; in short, investors receive poor compensation for taking on more credit risk.

That said, there are still sound reasons to hold higher yielding bonds. Our analysts believe the attractive level of yield offered, and improved credit quality of the asset class as a whole, means high-yield bonds could provide another source of income for portfolios.

If you are interested by fixed income investments, you can read more insights from Capital Group here.

This article was written in partnership with Capital Group.