Interview with Lamisse Kandil, agro-development engineer, and Arnaud De Lavalette, microfinance expert – both responsible for the “Fermier 2.0” programme at ADA (Appui au Développement Autonome). They explain to Forbes how this digital platform, operational in Senegal and Ethiopia, works.

What does the F 2.0 or Fermier 2.0 programme consist of?

Lamisse Kandil: Fermier 2.0 addresses the issue faced by small-scale producers who do not have access to bank financing. Often, this is because they do not have a bank account, do not fit the risk profiles sought by financial institutions, or are located in remote areas. This financial exclusion has real consequences: without financial means, they cannot access seeds or fertilisers, which limits their yields. The platform also ensures that the loans are used for agricultural purposes and are not diverted to other ends.

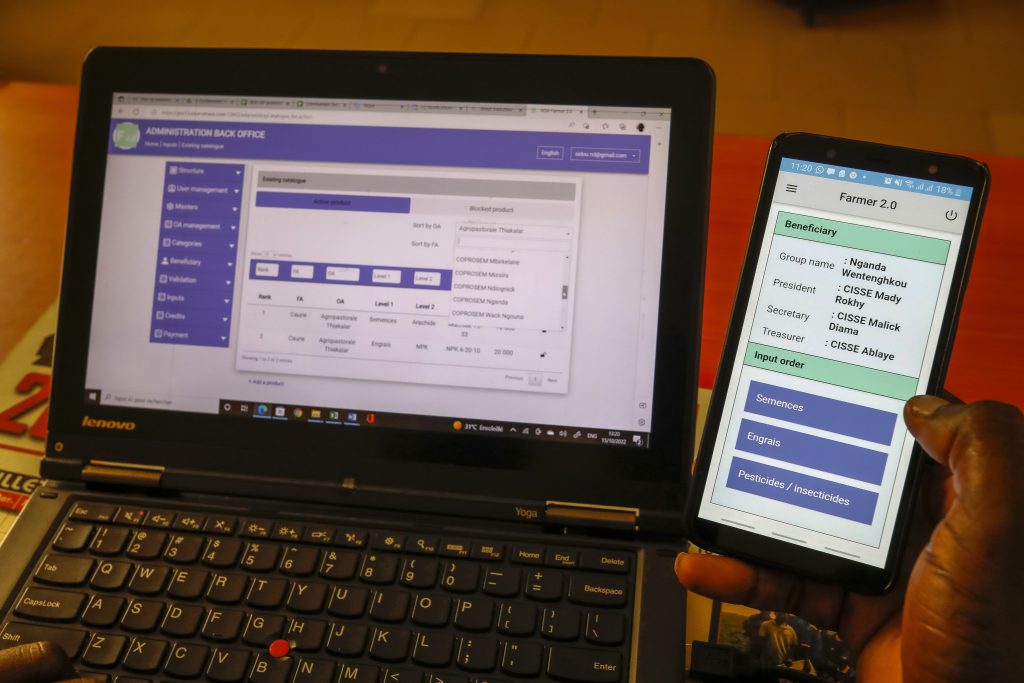

Arnaud De Lavalette: The objective of this programme, which I have been working on for five years, is indeed to foster the financial inclusion of smallholder farmers in Africa, particularly in Senegal. The first operations were carried out in 2020. Agriculture in Africa represents a quarter of the GDP, employs two-thirds of the working population, yet only receives 3% of credit – including that granted to small agri-food processing businesses. Funding for small-scale producers remains extremely limited, even though their individual needs are often between €100 and €200 to purchase inputs such as fertilisers and/or seeds. In practical terms, F2.0 strengthens the links between agricultural cooperatives, their members – the small producers – and microfinance institutions (MFIs), enabling them to exchange information such as credit needs to increase financing to small producers. For example, cooperatives can report producers’ needs for input financing directly through the platform, and suppliers are paid directly by the cooperatives. Smallholders receive the inputs without handling the money themselves. This guarantees that the loans are used for agricultural purposes and is a real advantage for our partner financial institutions. In 2024, we granted, via local MFIs, around €2.5 million in loans for the purchase of seeds and fertilisers.

“Our role is not to grant loans. We act as an intermediary and catalyst, facilitating access to finance […]”

How does this project align with ADA’s strategy?

Arnaud De Lavalette: Until 2022, ADA’s strategy had a rather generalist approach to microfinance. Since 2023, we have focused on several themes, namely agriculture – through the financing of producers and agricultural value chains – access to basic services for vulnerable populations, and support for youth employment and entrepreneurship.

How have these figures evolved since 2020?

We started with less than €50,000 in input financing in the first year. In total, more than €8 million in loans have been granted since the start of F2.0.

Who are your counterparts on the ground?

Lamisse Kandil: These include MFIs, cooperatives and farmers’ organisations, and their members – smallholder farmers. Working with cooperatives creates additional leverage and mutual guarantee mechanisms.

What makes the F2.0 platform innovative and useful?

Arnaud De Lavalette: Our goal was to address the challenges faced by small producers by reducing the cost and risk of financing for microfinance institutions. Regarding risk, the platform provides credit traceability, which reassures MFIs. Moreover, it offers a clear view of smallholder needs. Our field team has bridged two worlds – agriculture and finance – through digital tools and, crucially, human presence. The platform helps reduce operational costs. We work with cooperatives, not with each individual producer. Cooperative leaders play a key role in gathering the necessary information. In Senegal, we are working with 60 cooperatives, coordinating around 7,000 producers.

Would you say digital technology is now central to the microfinance sector?

Arnaud De Lavalette: Yes. I joined ADA eight years ago, working on a project called DFI (Digital Finance Initiative). It supports MFIs in Africa by tackling issues such as network connectivity and opening distribution channels, enabling clients to perform bank-to-wallet or wallet-to-bank transactions, and facilitating core banking migrations.

Lamisse Kandil: In countries like Senegal, one cannot talk about finance without considering the digital aspect. However, not all areas enjoy the same level of connectivity. So, we must adapt to each country and context. Our platform can be used offline without data loss.

What is ADA’s role? Could a local solution replace your function?

Lamisse Kandil: Our role is not to grant loans. We act as an intermediary and catalyst, facilitating access to finance and ensuring the well-being of all our stakeholders. We provide the digital platform. We demystify financial concepts for smallholders. A local intermediary could exist in theory, but currently does not. We offer various types of added value. We know all these MFIs and act as a neutral link between them. We also support farmers in their ecological transition and in seeking partnerships.

Arnaud De Lavalette: The platform is highly useful, but it is of no use on its own. We work in an environment where 80% of people are illiterate and live on about $2 a day. These are among the poorest populations in the world, in a country that is doing relatively well economically and seeing the rise of a middle class. This is why we also have an F2.0 team on the ground and why we coordinate with MFIs to serve these low-income populations.

What are your upcoming projects?

Arnaud De Lavalette: We anticipate crossing the €5 million threshold and reaching 10,000 beneficiaries. We also aim to expand F2.0 to other countries, such as Côte d’Ivoire or Benin.

Lamisse Kandil: The challenges seen in Senegal are present in many countries. We want to make this programme a sustainable initiative. Together with the MFIs, we are also working on creating an autonomous F2.0 entity under Senegalese law.

Has the situation at the Caritas association in Luxembourg had any impact on ADA?

Arnaud De Lavalette: At ADA, financial flows and payments are tightly controlled, with multi-layered systems to verify even the smallest transactions. Such issues are virtually impossible at ADA.

How is ADA funded?

Arnaud De Lavalette: ADA’s activities are financed by several donors, the largest being Luxembourg’s Ministry of Foreign and European Affairs, Defence, Development Cooperation and Foreign Trade. With this Ministry, ADA establishes a four-year strategic plan. We have around fifty employees in Luxembourg, plus about fifteen long-term consultants in the field.